| ☮️ Бренд | Vavada |

| ☮️ Официальный сайт | |

| ☮️ Рабочее зеркало | Актуальное зеркало - перейти на зеркало |

| ☮️ Платформы | iOS, Android, Windows |

| ☮️ Количество игр | 3600+ |

| ☮️ Языки | RU, EN |

| ☮️ Саппорт | Live-чат, контактный телефон, skype, email |

| ☮️ Мин. депозит | 50 RUB |

| ☮️ Мин. вывод | 1000 RUB |

Отличия официального сайта Vavada мошенников

Репутация игорного клуба Вавада создается геймерами которые комментируют его работу и оставляют отзывы на различных площадках. Анализируя мнение аудитории, человек может составить личные выводы об имидже casino. Наличие положительных отзывов — это первое отличие добросовестного оператора от афериста. Также важно, чтобы платформа функционировала на основании официальной лицензии Кюрасао. Электронная версия этого документа должна находиться в открытом доступе для гостей и клиентов сайта. В этом случае игроки могут изучить юридическую информацию о лицензиате и проверить регистрационный номер договора в соответствующем реестре. Наличие действующего лицензионного соглашения дает пользователям дополнительные гарантии честности работы ГСЧ, своевременных выплат выигрышей и защиту в случае возникновения правовых споров.

О том, что brand Вавада 2024 не имеет ничего общего с мошенническими схемами также свидетельствуют такие факторы:

- Высокий уровень конфиденциальности персональных данных, который обеспечивает двойное шифрование файлов и протоколы SSL.

- Партнерские отношения с многими стримерами и блогерами.

- Огромная коллекция оригинальных симуляторов. В их число входит 5000 игровых автоматов с виртуальным и лайв режимом.

- Наличие круглосуточного саппорта, где работают профессиональные консультанты и нет чат-ботов.

Последнее отличие топового ресурса от мошеннического бросается в глаза каждому посетителю. Это продуманное и простое оформление страниц. Над навигацией и дизайном работают специалисты, которые отмечают недостатки платформы и постоянно улучшают веб-сервис для удовлетворения всех потребностей клиентов.

Зеркало сайта Vavada на сегодня

В России и ряде других государств азартные игры до сих пор запрещенное развлечение. Такие службы контроля, как Роскомнадзор соблюдают нормы законодательства, поэтому ответственны за блокирование работы онлайн ресурсов, связанных с гемблингом. При этом ФНС не предоставляет лицензии ни зарубежным, ни российским заведениям, из-за чего проблема обхода блокировок годами продолжает быть актуальной. Так что зеркальные копии основного портала остаются оптимальным решением.

Их используют большая часть игроков, не замечая разницы между дубликатами за исключением измененного доменного адреса. URL отражений постоянно меняется, поэтому администрация регулярно распространяет обновленные ссылки на площадках партнеров казино и отправляет актуальные домены клиентам в новостной рассылке. Тем, кто не сохранил зеркало Вавада на сегодняшний вечер, предлагает обратиться к модераторам официальных сообществ в Инстаграм, Телеграм и ВК. Они предоставят действующий URL по заявке. Либо скопируйте линки в публикациях и закрепленном сообщении.

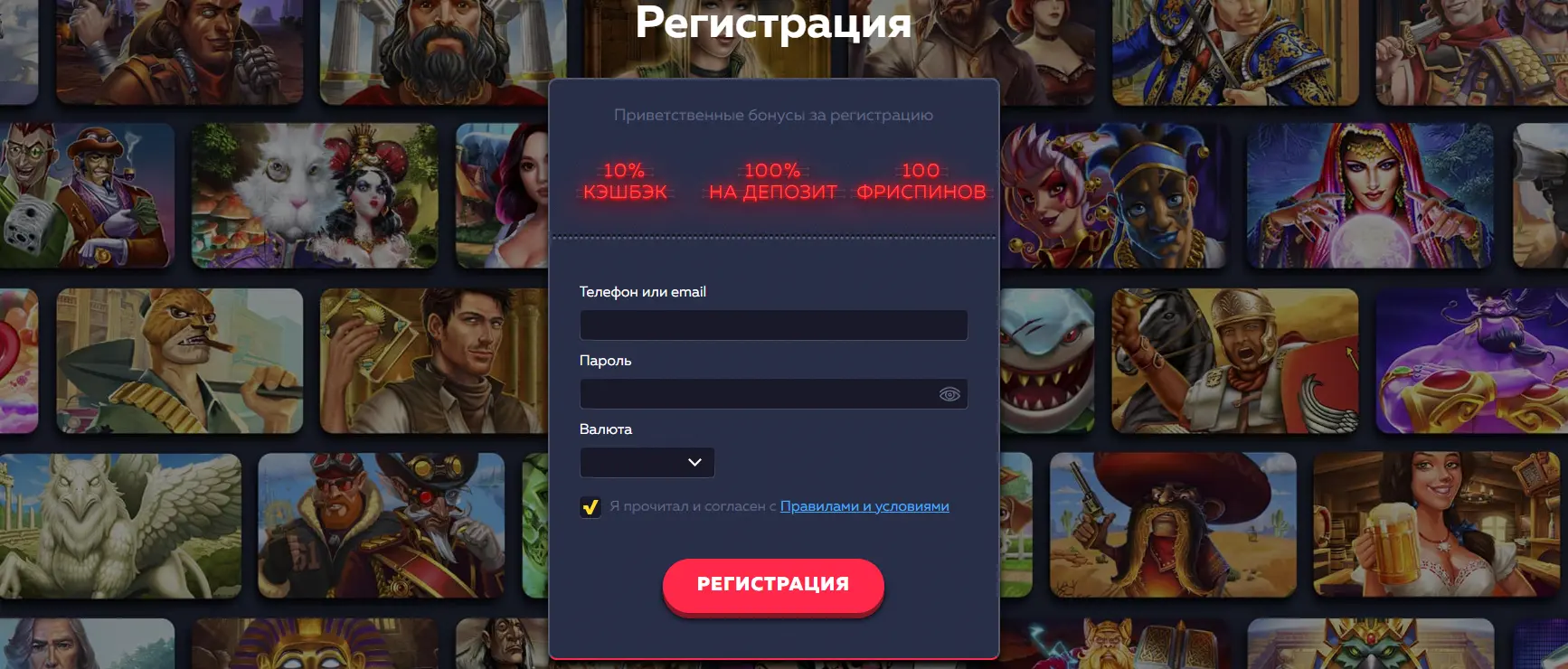

Регистрация и вход на Вавада

Чтобы начать игру на деньги, нужно создать личную учетную запись на площадке. Это доступно людям от 18 лет, так как клуб не допускает к азартным развлечениям несовершеннолетних. Новички проходят процедуру в браузере или приложении, после того как нажмут кнопку «Регистрация». Для этого они выполняют такие действия:

- Вводят логин (e-mail) и придуманный пароль в пустые строки регистрационной формы.

- Выбирают подходящую валюту для платежных операций.

- Читают условия конфиденциальности и подтверждают ознакомление с ними.

- Завершают процесс онлайн регистрации на Вавада кликом по соответствующей кнопке.

Когда процедура закончена, новоприбывший авторизуется в системе. Но прежде чем приступить к ставкам, ему требуется идентифицировать электронную почту, введенную в качестве логина. Нужно войти в личный кабинет, в первом окне кликнуть по «Отправить письмо» и получить его в своем почтовом ящике. Затем перейти по ссылке, тем самым подтверждая имейл. Дальше необходимо вернуться в профиль офиса и заполнить персональную анкету. Это обязательное требование для аутентификации нового клиента.

Приветственные бонусы и промокоды Вавада

Бонусная политика заведения предлагает воспользоваться бесплатными вращениями сразу же после регистрации. Новичок забирает 100 спинов для топового слота Great Pigsby Magaways, которые позволяют ему со старта срывать куш без финансовых вложений. Чтобы вывести моментальный доход, игроку придется его отыграть с вейджером х20. Отыгрыш происходит за реальные деньги. Но это условие клуба не принесет расходов, а наоборот, прибавит заносов в копилку геймера. Для выполнения требования наступает время пополнить депозитный счет. Именно в этот момент новоприбывшему вручается второй бонус Vavada на депозит. Это двойной множитель платежа, который активируется если сумма операции не превышает 1000$. Денежная прибавка доступна для ставок на любом аппарате игротеки. Ее вейджер равен х35. Прокрутить и вывести вознаграждения из приветственного пакета стоит не позднее 14 дней. В ином случае бонусы безвозвратно сгорают.

В дальнейшем гемблер может рассчитывать на неограниченное количество промокодов. Это подарочные коды с бесплатными опциями для геймплея. Узнать какой bonus спрятан в кодовой комбинации доступно только после активации. Активные пользователи портала получают свежие промокоды Вавада через рассылку новостей или сотрудников техподдержки. Еще заходят на стримы партнеров casino или участвуют в акциях соцсетей, где вознаграждениями становятся промо.

Для тех, кто проигрался в отчетном периоде, казино дарит кэшбэк в размере 10%. Эти средства помогут отыграться и вывести кэш после прокрутки с небольшим коэффициентом — х5. Средства кэшбэка разрешается тратить на свое усмотрение.

Турниры Vavada: какие форматы розыгрышей доступны геймерам

Фишкой игорного заведения являются еженедельные соревнования в топовых автоматах. Они проводятся в разных форматах, которые различаются между собой некоторыми нюансами достижения победы. К ним относятся:

- Икс турнир Вавада. В этом состязании участники вращают барабаны из предложенного администрацией списка, используя денежные единицы для ставок. Призерами становятся 150 соревнующихся, которые в ходе сражения сорвали наибольшую сумму множителей. Вознаграждением за лидерство является часть от капитала 65000$.

- X-Plus. Соревнование с такими же условиями, но с одним исключением — в рейтинг участников вносятся исключительно иксы от 100. Сотня игроков, занявших первые места в турнирной таблице, забирают фонд 50000$.

- Кэш турнир. Проводится для геймеров, которые достигли статуса «Бронза» и выше по системе лояльности Вавада. Этот розыгрыш — привилегия для активных пользователей, поскольку соревнующиеся делают ставки на бесплатные фишки. Без затрат у них есть шанс сорвать заносы и выиграть часть капитала в размере 25000$.

- Соревнование Vavada на фриспины. Предназначено для гемблеров ранга «Серебро» и выше. В этом состязании участникам позволено запускать один слот из списка доступных и не разрешается менять выбор до завершения сражения.

- MaxBet. Предлагает совершенно новые условия достижения победы. На денежный приз могут рассчитывать лишь те, кто поставил самые большие суммы в автоматах. Фонд розыгрыша 50000$.

Каждое событие анонсируется в соответствующем разделе каталога развлечений. Узнать подробные условия турниров можно в отдельных вкладках.

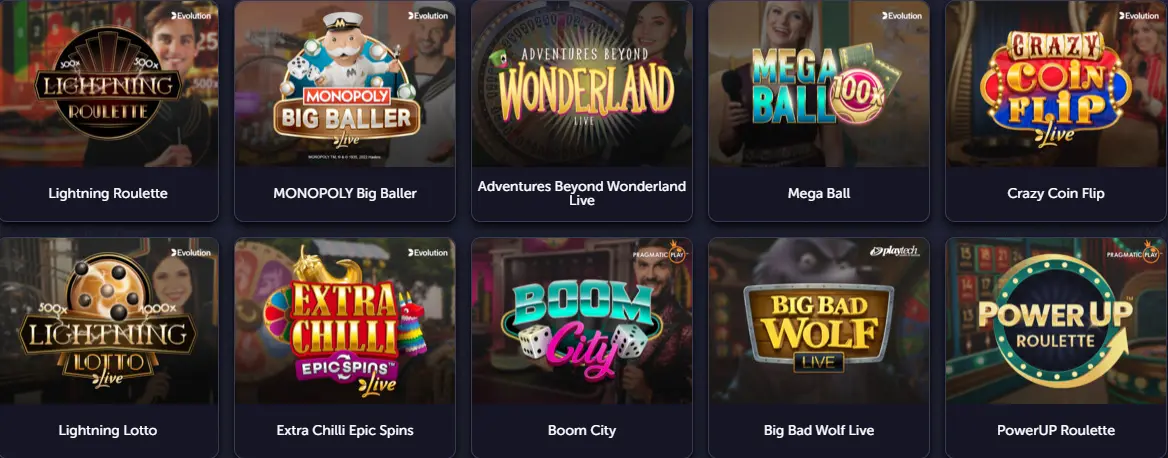

Live игры online casino Vavada

Наличие геймов с живыми дилерами не менее турнирных розыгрышей привлекает ценителей гемблинга. Прямые эфиры со студий провайдеров игрового софта довольно увлекательные развлечения, которые характеризуются высоким уровнем отдачи. В каталоге Вавада представлен широкий выбор настолок и слотов с профессиональными крупье. Среди них карточные игры, рулетки, монополия, кено, кости и такие игровые шоу, как Sweet Bonanza Candyland и Big Bad Wolf Live. Игрокам не приходится дожидаться начала трансляции, они запускаются ежеминутно в круглосуточном режиме. Если есть намерение играть и выигрывать, то откладывать нет нужды. Пополняйте депозит от 1$ и приступайте к игровому процессу.

Играй бесплатно в демо Вавада

На платформе не обязательно рисковать финансами, чтобы приятно провести время. Все барабаны игротеки и часть виртуальных настолок можно запустить в демонстрационном режиме и играть на виртуальную валюту. Хотя за пределы автомата средства не вывести, бесплатный геймплей поможет протестировать софт и набраться опыта начинающим геймерам. Для запуска тест-версии аппарата потребуется навести курсор на его обложку в игровом лобби и кликнуть по появившейся надписи «Демо». Если кнопка отсутствует, то очевидно, что симулятор не поддерживает демонстрационный режим.

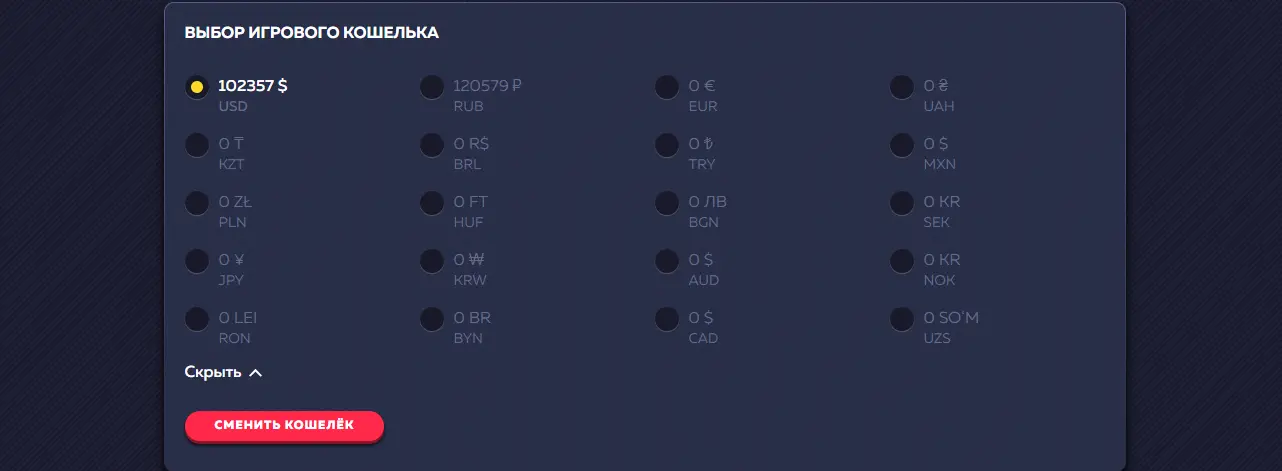

Кошелек: особенности проведения платежных транзакций

Для пополнения депозитного баланса и извлечений выигранного кэша геймеры используют раздел пользовательского кабинета «Кошелек». Он оборудован так, чтобы финансовые операции проводились с максимальным удобством и скоростью, поэтому на странице представлены более десятка способов оплаты. В их перечень входят международные платежные системы Visa и MasterCard, цифровые сервисы и криптовалютные провайдеры. Важно использовать один метод для внесения и вывода денег с Vavada, тогда транзакции проходят без задержек и 100% одобрением.

Как вывести деньги с Вавада

Для активации соответствующей вкладки на депозитном счету должно быть не менее 20$. Если требуемая сумма имеется, приступайте к оформлению запроса:

- Выберите платежную систему.

- Укажите размер платежной операции.

- Введите реквизиты.

- Отправьте заявку на обработку.

Обычно деньги начисляются через 2-5 минут. Если сотрудники финансового отдела загружены, то время ожидания зачисления средств увеличивается до 24 часов.

Как пополнить счет Vavada

Процедура внесения средств на игровой счет не отличается от описанной выше. Чтобы платеж прошел, потребуется пополнить депозит на сумму не меньше 1 доллара, но лимит может меняться в зависимости от нюансов работы выбранного финансового оператора. Платежи не облагаются комиссиями и зачисляются мгновенно.

Как сорвать джекпот

Делая денежные беты в топ слотах Вавада с функцией накопительного джекпота, игроки используют шанс срубить мега-приз. Список таких симуляторов получите в техподдержке или следите за публикациями в соцсетях. В банке казино накапливаются капиталы трех уровней главного приза, поэтому возможность выпадения крупного куша увеличена втрое. Начальный jackpot Минор самый доступный. Сейчас его сумма составляет 55$, что свидетельствует о том, что Minor недавно сорвали. Средний куш — Мажор. Его фонд более солидный и достигает 6800$. Самый желанный занос — Мега Джекпот, фонд которого составляет 280930$. Сумма основного куша продолжит увеличиваться до тех пор, пока любимчик Фортуны не сорвет крупнейший призовой фонд заведения.